You finance everything you buy. You either pay interest to someone else or you give up interest you could have earned otherwise. (opportunity cost)

Even If you don’t get a loan and you use CASH from a checking or savings account, it costs you interest.

How so ?

Opportunity cost.

If you go out and spend 50k cash on a new car, I know it feels good walking into the dealership as a strong cash buyer, (and you can still do that with infinite banking) but WHERE that cash is coming from can make a huge difference on your future and your legacy. If that cash is coming from a checking or savings account, you are losing the opportunity cost for that capital to work and grow interest for you and your family.

How much are you losing? Let’s look with a long term perspective.

At 5% – the 20 year opportunity cost of spending $50,000 cash is about $132,000

over 50 years…. its $573,000

over 100 years…..you are costing your family and future generations 6.5M when you use 50k of cash in this scenario.

Let that sink in. Think of some of the large purchases you have made in cash and what the opportunity cost of that was. Think about how many purchases there has been over your entire lifetime, your parents life times, your kids lifetimes….

This is how you think long term and plan for generations. Most people talk about generational wealth because it sounds invigorating, very few ever actually learn and make the decisions that build generational wealth.

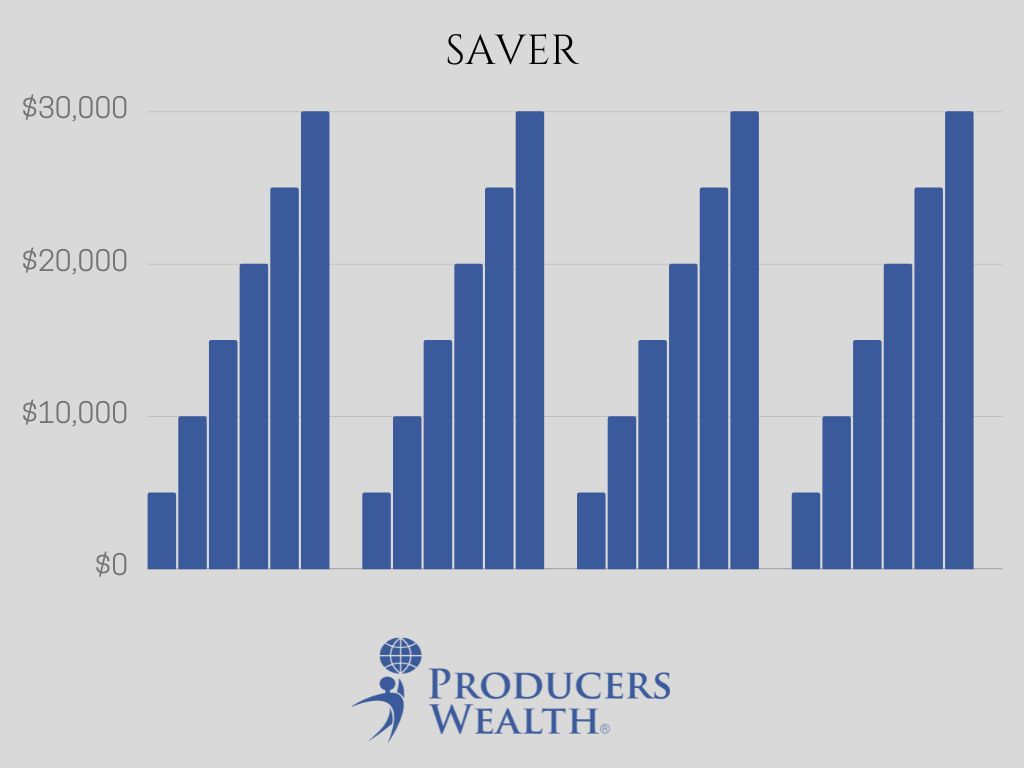

The saver saves up capital, usually inside a checking account or savings account, then spends it on a purchase OR an investment. Then, they have to save up capital again, another purchase comes, and they spend it, you can see the cycle here. Sure you might make a few bucks in interest and maybe you aren’t depleting your savings to $0 every time, but from a macro view this is still not the most efficient option.

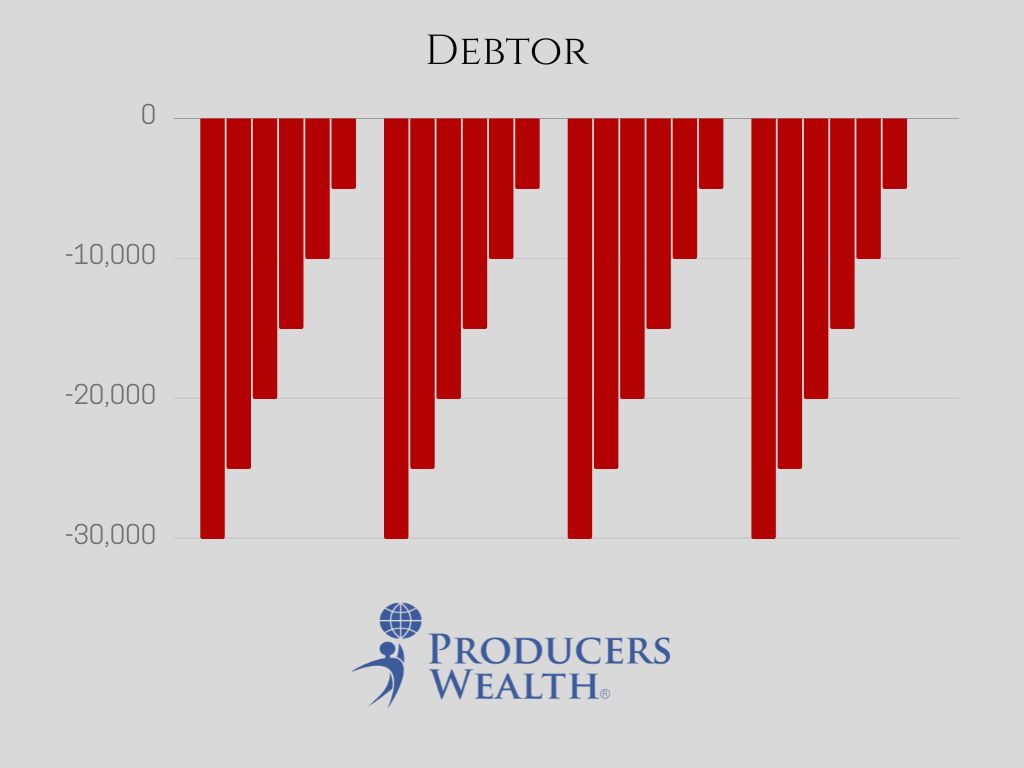

The debtor. You use debt to make purchases. You take out a loan and buy something, then pay back the loan, then its time for a new loan so you take out another, and pay it back just getting back to 0. Sure you may have savings in other areas but you still have capital going out of your ecosystem to pay this expense.

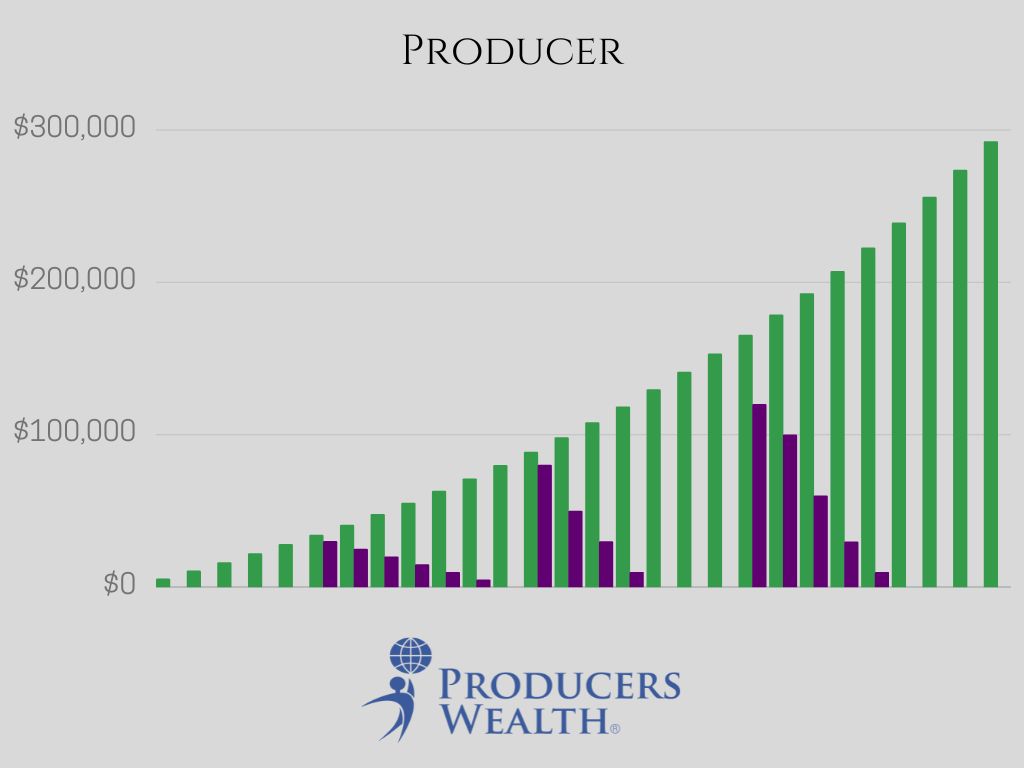

The Producer collateralizes an appreciating asset and makes a purchase so that they never lose the opportunity cost of their capital and it continues to grow even when it is spent. Yes, you have to pay the loan back BUT in this scenario you have two types of interest working against each other, both for you. Your asset is appreciating and growing compound interest, and your paying back your collateralized loan on an amortized interest basis. One has an increasing basis, one has a decreasing basis.

Now you can do this with most assets BUT some are better than others for this strategy.

With a properly designed Life Insurance Policy you build a Cash Value Account. Your cash value account grows uninterrupted compound interest tax free (If its designed properly) AND it can be used as collateral for loans from your insurance carrier to go make purchases just like in the producer image.

With the right carriers, the right product, and the right designs, by contract you have the right to take a loan from the insurance carrier with your cash value as collateral at any time with no credit check, no income verification or any normal loan process.

You still get to walk into the car dealership or closing table as a “cash buyer” but this time, the cash is coming from a cash value account which continues to grow so you do not lose the opportunity cost of the capital. The capital inside your cash value account will continue to earn uninterrupted compound interest.

Disclaimer and Waiver

Michiel Laubscher & Laubscher Wealth Management LLC is not an investment advisor and is not licensed to sell securities. None of the information provided is intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, of any company, security, fund, or other offerings. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information contained herein is at your own risk. The content is provided ‘as is’ and without warranties, either expressed or implied. Michiel Laubscher & Laubscher Wealth Management LLC does not promise or guarantee any income or specific result from using the information contained herein and is not liable for any loss or damage caused by your reliance on the information contained herein. Always seek the advice of professionals, as appropriate, regarding the evaluation of any specific information, opinion, or other content.