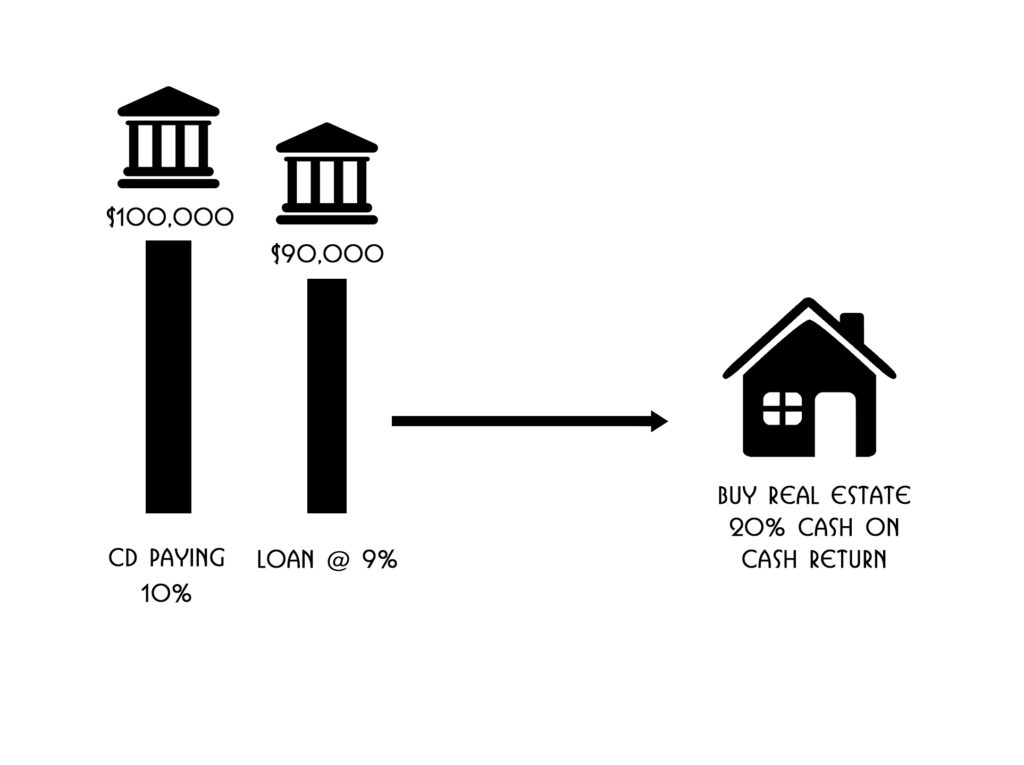

Let me tell you a story about my first mentor. He was an older guy I met at a real estate investment club in 2001. He explained to me that in the 1970s, he would take $100,000, go to the bank, and put that $100,000 in a certificate of deposit. This might sound insane today, but in the 70s, the returns were 10% or higher.

After he did that, he would go to the exact same bank and say, “Mr. Banker, I have a CD in your bank for $100,000. Can I get a loan that is secured by that $100,000?”

The banker would say, “Of course.” My mentor would get a loan for $90,000 at 9%. He would then go and buy real estate with that $90,000. After buying the real estate, he would then pay the loan down with the income he was generating from the real estate. All the while, he had $100,000 compounding in the bank at a rate of 10%. His original $100,000 was growing, while he borrowed against it to create an asset that generated revenue, had great tax benefits, and appreciated in value through proper management. He would repeat this strategy over and over again… When he told me this story, my mind was blown.

This is a powerful strategy. But what is ten times more powerful than that is doing that exact same strategy with a dividend-paying whole life insurance policy with a mutual insurance company. When you fund your life insurance policy and build up cash value, your cash value grows tax-free, while the CD wouldn’t. You can establish a line of credit against the cash value of up to 90-95%. Then, you can take that money and invest in your business.

Your money is growing uninterrupted, compounding tax-free in your policy. You took a policy loan secured by it to finance the growth of your business. You, as the business owner, the #1 asset of the business, are protected because there is also a death benefit on the policy, as well as a disability rider, meaning that if you become disabled, that policy is paid up and you don’t lose the policy or the cash value. Eventually, you can take money from the policy to fund the back end of your life tax-free as a business owner.

Essentially, life insurance is the perfect vehicle that allows you to adopt my mentor’s strategy and add rocket fuel to it.

When you read the words “life insurance” at the end of that story, did you flinch? Did you imagine a slimy salesperson peddling a scam? Did you contemplate throwing the book across the room and running away?

Yes, it’s true, this is a book about a life insurance strategy that is part of a holistic wealth strategy.

Specifically, this is a book about using a whole life insurance policy with a mutual insurance company to store your excess capital and become your own bank.

Life insurance doesn’t quite have a glowing reputation… At a cocktail party, if someone asks “What do you do?” and the person says they’re a lawyer, doctor, or nuclear physicist, everyone will say “Oh, wow.” They’ll smile, nod, and ask follow-up questions like, “So what type of law do you practice? Where did you go to medical school? Do you build rockets?” But if the person answers “What do you do?” with “I sell life insurance,” not only will there not be a follow-up question, but everyone will leave the person’s presence immediately.

If life insurance is so widely hated, why bother talking about it?

Before you throw the book across the room and swear off life insurance forever, consider this: what if this solution could provide you with…

- Clarity (which turns into Confidence)

- Certainty

- Predictability

- A Tax-Free Alternative

- Family Contingency Planning

- Business Contingency Planning

- Asset Protection (For your #1 asset… you)

If a solution could provide you with all of these things, isn’t it at least worth investigating?

A whole life insurance policy with a mutual insurance company is the perfect vehicle to store your excess capital so you can maximize your control over your destiny and continue to bet on yourself.

You may have heard of this solution under other names: “infinite banking,” “bank of yourself,” “cashflow banking,” “private reserve strategy,” and more. In this book, we’re going to demystify what this life insurance strategy actually means–and why many successful business owners have been using it since the mid 1800s.

The Perfect Savings Vehicle

Why is life insurance the perfect savings vehicle?

- It’s safe. Your principal is guaranteed never to go down in value.

- Your capital is contractually guaranteed to grow. There’s a big difference between contractual wealth and statement wealth… Contractual wealth is a private contract between you and a mutual life insurance company. By contract, your net worth increases with each and every contribution that you make. Meanwhile, a statement just gives you a snapshot of how your investments are performing. In our perfect savings vehicle, we want a contract that guarantees our wealth will grow.

- Although dividends are not guaranteed, you get to participate in the profits of the mutual life insurance carrier by receiving a dividend. They have paid dividends for over 170 years consecutively.

- The tax advantages are fantastic. Tax-free growth, dividends are tax-free, tax-free access to savings, tax-free distributions for retirement, and a tax-free death benefit.

- The death benefit of the life insurance policy is a multiple of the cash value account value, which is distributed to beneficiaries tax-free.

- There is a guaranteed death benefit so that when you pass away, your family gets capital tax-free. We don’t want a 401k or traditional IRA… If you have $1 million in either of these vehicles, you can’t guarantee

- that your family will receive $1 million upon your death because it’s tied to the equity market and is taxable. Since we can’t predict what tax rates will be in the future, we can’t predict how much your family will receive.

- It’s not exposed to market volatility because it’s not correlated to the equity markets. If the stock market goes down 50%, nothing will happen to the capital inside this vehicle.

- It gives you liquidity. You have guaranteed access to your savings for emergencies and opportunities.

- It’s protected from creditors. As a business owner in the United States, you do not have to do anything wrong to be sued. You have a target on your back, and you may not even be aware of it. If you’re in a situation such as a car accident, and someone finds out you’re a business owner with a high net worth, they see dollar signs…

- There’s a hedge against inflation. Inflation reduces the value of your capital over time. The Federal Reserve openly states that it’s trying to keep inflation at 2%. 6 To beat inflation, we want a vehicle that compounds at a higher rate than inflation.

- You have full control with no strings attached. Qualified plans have more strings attached than Pinocchio had before he became a real boy… We want to find a vehicle that avoids this.

- If you become disabled, there are benefits to help you, and you will not lose the vehicle.

- This vehicle is transferable so you can change the ownership and beneficiaries when and if needed.

- This vehicle is a private contract, which is very important. Why? If you have a lot of money in the bank, everybody knows. That information has been sold to third parties. But when you have a vehicle with a private contract, nobody knows you have that money unless you declare it and put it in a financial statement, and nobody knows if you access any of the cash value through a policy. There are no credit reporting agencies that your assets are reported to.

- There is flexibility of premium payments and policy loan repayments.

- You have leverage. You can place your capital as collateral for loans, allowing your capital to work in two places simultaneously.

- There are no contribution limits as there are with qualified plans like 401Ks, IRAs, and Roth IRAs.

- A track record of over 170 years as a vehicle that provides certainty, security, and predictability.

The only negative with this perfect vehicle is that you can’t deduct your premiums from taxes today. (But this is okay… I’ll explain why later).

The Aligned Capital Strategy™ has all of the features listed above… But wait, there’s more.

You can have your cake and eat it too. You can put money in the policy and then use it in your business. This isn’t just a bucket you’re drawing from. You’re not actually touching the cash value that continues to grow uninterrupted, tax-free.

You have the ability to use the money to grow your business while that money compounds and grows tax-free for you.

You might read this and think, “That sounds too good to be true.” I get it. It does. But let’s look at why this is possible…

On one side of the table, you put capital into your vehicle and you get all of these incredible benefits we talked about. But on the other side of the table, the life insurance company collects the premiums upfront. Just through underwriting, they’re already profitable. Then, they invest that capital. When you take a policy loan, the life insurance company has two pieces of collateral, so they’re protected twice. They have your death benefit and cash value, so they can guarantee you a policy loan. If you try to cash out your policy with a loan, they’ll just deduct the loan from the cash value. If you pass away with an outstanding loan, the insurance carrier will deduct the loan from your death benefit.

It’s a win-win situation for both you and the life insurance companies.

Watch all of our educational videos on Infinite Banking here.

Disclaimer and Waiver

Michiel Laubscher & Laubscher Wealth Management LLC is not an investment advisor and is not licensed to sell securities. None of the information provided is intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, of any company, security, fund, or other offerings. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information contained herein is at your own risk. The content is provided ‘as is’ and without warranties, either expressed or implied. Michiel Laubscher & Laubscher Wealth Management LLC does not promise or guarantee any income or specific result from using the information contained herein and is not liable for any loss or damage caused by your reliance on the information contained herein. Always seek the advice of professionals, as appropriate, regarding the evaluation of any specific information, opinion, or other content.