Nelson Nash, creator of the infinite banking concept, who wrote Becoming Your Own Banker, told me this story:

The world is mostly made up of water.

The surface of the Earth is covered with oceans that are connected to each other, and there are rivers that are all connected to the ocean. Under the land, you have underground water.

The Sun heats up the Earth, clouds start to form, and the clouds get heavier and heavier until they eventually break, and then water returns to Earth in the form of rain.

Where does it end up? It goes back into the oceans or rivers, which are all connected, or it seeps into the land to the underground water, which is connected to the rivers and the oceans.

It’s all connected. And this system repeats over and over.

What does this have to do with money?

Think about the banking system. The commercial banks have this all figured out. Money resides in the banking system. The famous bank robber Willie Sutton, on being asked why he robs banks, said, “Because that’s where the money is.”

So there’s money in the banks, but money always leaves the banks. It could leave through loans or through lines of credit payments, but it always comes back to the banking system.

If somebody were to apply for a mortgage from a bank to buy a house, the bank gives them a check to take to the closing. They hand over the check at the closing table and get the keys to the house. What happens to the check? The check is then deposited into the seller’s bank account. The money returns to the bank…

If you went to a restaurant for dinner tonight, you would pay for the meal, and the server would run your credit or debit card into the restaurant’s merchant account. Money goes from your credit card or bank account into the restaurant’s merchant account. The restaurant owner later uses that money to pay the waitstaff, the cooks, and the dishwashers. Where does the money end up? In all of their bank accounts.

Like water leaving the Earth and returning to it, money constantly leaves and returns to the banking system.

Banks have figured out how to capture capital in their system and never lose it.

How can we use this exact same concept in our own lives for our personal economy, our business economy, and our investing economy?

We can set up pools of capital in our own personal, business, and investing economy, and these pools of capital will do the exact same thing for us.

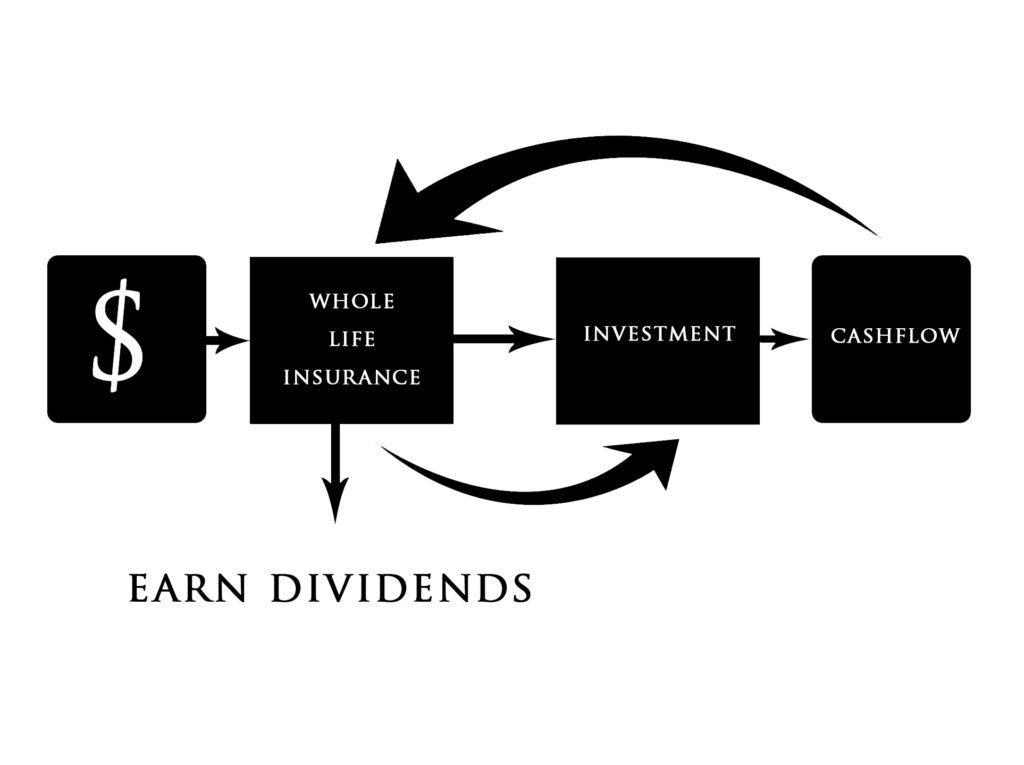

You can fund your policy with capital that comes into your economy, capturing it inside the policy. Once you put it there, it never leaves. You can establish a line of credit against it, so you become your own source of financing. You can use it to finance the growth of your business, which generates more capital. That capital is then used to pay down the line of credit, and you continue to fund the policy premiums. You’ve established this pool of capital in your own personal business and investing economy that’s now capturing the value of what you produce and create in the marketplace. As you continue, it snowballs.

The Banking Model

What does a bank do?

It takes in deposits. Why would people deposit money in a bank? In exchange for keeping your money in the bank, you get benefits such as using a debit card, being able to transfer money, paying bills electronically, and earning a decent return.

But deposits are just the front end of the business model. Everyone knows the money is made on the back end…

The back end of the banking model is lending. The bank stores all of the capital that customers have deposited into it, and they lend this capital to other customers. They may issue credit cards, personal loans, automobile loans, business credit cards, business lines of credit, mortgages, commercial mortgages, and more.

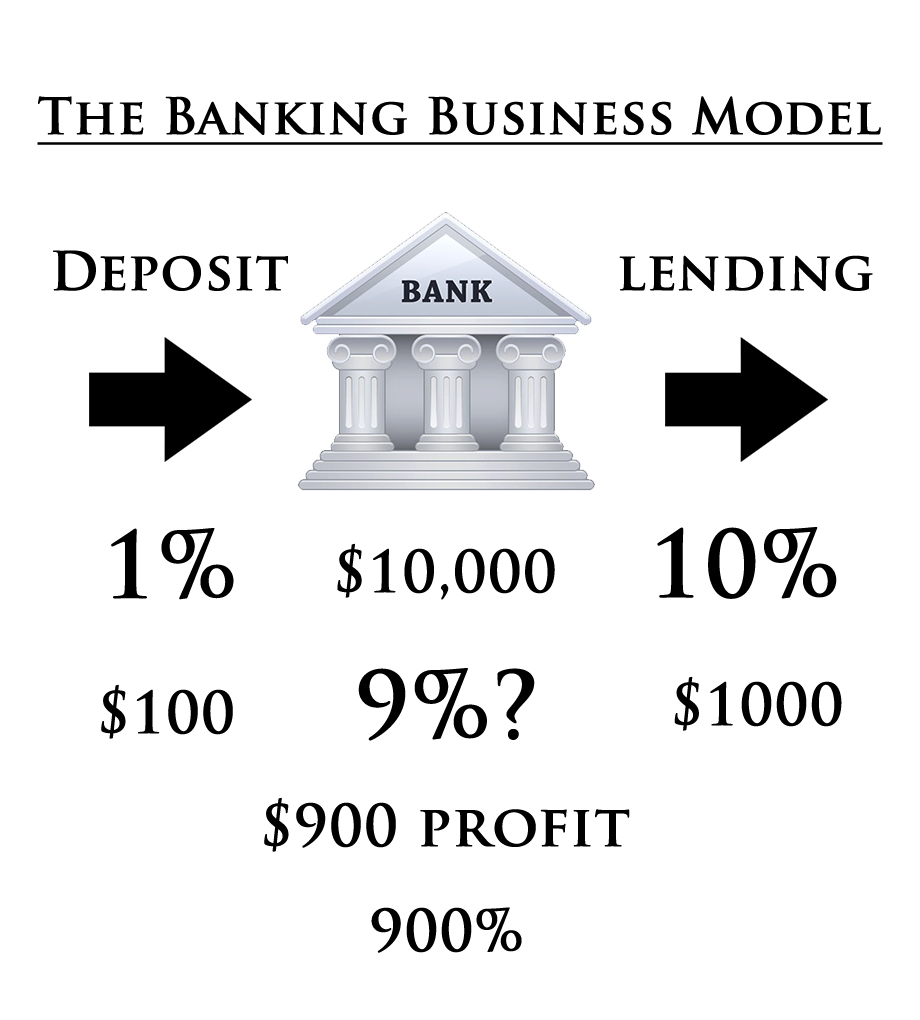

Let’s say you put $10,000 into the bank, and they pay you 1% ($100). On the back end, they loan out that $10,000 at 10%, so they make $1,000.

Someone might look at that and say, “Nice, they made a 9% spread.”

Not quite… There’s one thing missing. You deposited $10,000 into the bank account on the front end. They lent that money out on the back end. The only money the bank had in the transaction was the $100 they paid you. The bank didn’t make a 9% spread… It made a 900% spread.

Who benefits in this model? The banker and the owners of the bank.

But what if you could set up your own banking system that you could benefit from?

In life, you finance everything you buy. Whether you pay cash for it, leverage credit for it, or rent it, you’re financing everything. Your banking system is at the forefront of letting you be the owner of the system that now finances your family, your business, and other investments.

Your need for financing during your lifetime exceeds your need for life insurance protection. Yes, you have a death benefit in your policy, but the real purpose of your policy is the banking system.

The average American pays 34.5% in interest and 30% in taxes (income, real estate, sales). So 64.5%, which is basically two-thirds of the income of the average American, goes to banks and the government.

This banking system is going to help you create your own pool of capital so you can recapture the interest that’s paid out to third parties. (And later in the book, I’ll show you a tax strategy to recapture the money you lose to taxes).

Maximize Your Banking System

There are four types of people in the banking system:

- Consumers, who are people that borrow to spend

- Producers, who are people, such as business owners, who borrow capital to create value and are the biggest depositors in banks

- The banker, who finances both the consumers and producers

- The bank owner, who owns the system

- When you create your banking system, you take on the role of the bank owner.

- You can follow the banking model with your life insurance policy. On the front end, you pay premiums and deposit money into your banking system. On the back end, you can lend yourself money when you need it for opportunities or emergencies.

With this system, you can plug cashflow leaks and lower the cost of your insurance. You can opt for less expensive insurance with the highest deductibles and use your family bank to cover deductibles should you have an emergency.

When I bought health insurance for my family, the gold plan was $3,500 a month for four people, while the bronze plan was $1,000 a month. We opted for the bronze plan and deposited the $2,500 we saved into our family bank. If an emergency happens, we can use that money to pay the deductibles. When I had an emergency appendix surgery, I used a policy loan to pay my high deductible of $17,000. But if no emergency happens, that money stays in the banking system and compounds.

Just as a leak in a pool allows water to escape, a leak in your banking system allows capital to leak out, making your system inefficient. Insurance deductibles are one of the most common leaks people have. If you have a family bank, you don’t need insurance for potential fender benders or hospital visits.

My philosophy is that insurance is not there for fender benders or replacing broken windshields. It’s for catastrophic events. Insurance exists so that you don’t suffer a loss in your financial situation if a catastrophe occurs. It puts you back in the situation you were in before the catastrophe. For example, if you are in a major accident and your car is totaled, insurance puts you back in the situation you were in before the accident—you have a car. Meanwhile, if you have a fender bender, rather than paying for insurance, you may be better off writing a $500 check to get the car repaired.

When you have a banking system, you already have the ability to cover emergencies through policy loans. Meanwhile, with insurance, there’s always the possibility that you never need to utilize it, in which case that money has leaked out of your bank for no reason.

Using a banking system as insurance rather than purchasing other policies saves our clients thousands of dollars per year.

That $2,500 a month I saved amounts to $30,000 a year. Over a period of just five years, that’s $150,000 saved.

On the front end of your banking system, you make deposits that build up equity and cash value in your banking system. With every deposit, your family’s net worth increases, guaranteed. There’s no other vehicle I know of that can do that.

Yet you also have access to the lending arm of your bank. You can use policy loans to pay for things you’re going to pay for anyway, allowing your capital to compound in the bank. You can give yourself personal loans, college loans, auto loans, business loans, and mortgages. You can buy a house, buy a car, send your kids to college, and invest in rental properties all with loans from your policy. You can take any type of loan you would ordinarily take from a bank, except the difference is that you’re now making payments to your own banking system. As you are paying your own banking system back, you have a revolving line of credit. You don’t have to pay off all of the loans from your system to get access to another loan from the system.

Borrowing from your own banking system allows you to patch

another leak in your pool, which is outstanding loans to banks or credit card companies, with astronomical interest rates that eat away at your capital. When you establish your family bank, you can pay off inefficient loans to third parties with your banking system and then repay your own system. As Ben Franklin once said, “Beware of little expenses–a small leak will sink a great ship.”

It may take time for you to build up your bank, but you have certainty that whatever you put in your bank will be there years from now. When you establish your own pool of capital and begin to fill it, it feels like building a swimming pool and filling it with water, thinking, “I can swim in that pool soon!”

You’re eager to begin your journey with the Aligned Capital Strategy™, but you may be wondering, “Where do I find the money to start my policy?”

When you plug the leaks in your personal, business, and investment economy, you’ll recoup thousands of dollars per year that can be used to fund and fuel your life insurance policy.

You can stop contributing to your 401(k) (or only contribute up to what your company will match) or Roth IRA (or only contribute up to the max). In some cases, it may make sense to cash out of qualified plans and use the capital to fund a life insurance policy.

Any excess capital such as savings, tax refunds, inheritance, or proceeds from selling a business or real estate, can be used to fuel your system.

Beyond these sources of capital, you can also consider making small lifestyle changes to have more capital available to fund your policy.

Now, when I say lifestyle changes, I don’t mean adopt a scarcity mindset and pinch pennies.

Instead, I encourage you to think like a wealthy person and view all of your expenses as investments.

For example, a gym membership isn’t an expense. It’s an investment in your health and longevity. A vacation with your family isn’t an expense. It’s an investment in your happiness and relationships with your loved ones. Even your electricity bill is an investment… It enables you to be productive.

But some things you purchase are expenses, not investments. Anything frivolous that doesn’t make you happy or help you move toward your goals is an expense. For example, buying luxury products just to impress other people is an expense.

Evaluate all of the things you spend money on and ask yourself, “Does this add value to my life or take value away?” Eliminate spending on anything that has no value and consider everything else an investment. Invest the money you’ve reclaimed from frivolous expenses into your life insurance policy.

Another way to find capital is to refinance from a 15-year mortgage to a 30-year mortgage. This is the opposite of advice you’ve probably heard from financial influencers. Believe it or not, a 30-year mortgage is the most optimized mortgage. If you take out a 15-year mortgage, your payments are higher, which means you’re paying the bank back quicker in money that’s worth more today than it will be worth in the future. Also, you’re increasing your risk as the buyer of that property. The more equity you have in a property, the less risk it is for the bank and the more risk it is for you.

But if you lock in low-interest rates for a 30-year fixed loan, you free up more cash today–and your cash is worth more today than it will ever be due to inflation. You can then put that cash in your own banking system so it can compound.

You may be reading this thinking, “What have I done? I’ve paid off my mortgage, and my money is just sitting there doing nothing.” You can get a home equity line of credit and then access that equity to put your capital to work in a policy.

With the Aligned Capital Strategy™, you can have the best of both worlds: you know you have the capital to pay off your 30-year mortgage at any time, yet by not paying off the mortgage, you have your capital growing tax-free, giving you an opportunity fund to make investments and grow your wealth. This is an ideal situation if one spouse is more conservative with money while the other spouse is more aggressive with it.

Using a combination of these approaches, you can patch up the leaks in your financial system, pool your capital into your life insurance policy, and Get Wealthy For Sure™.

Watch all of our educational videos on Infinite Banking here.

Disclaimer and Waiver

Michiel Laubscher & Laubscher Wealth Management LLC is not an investment advisor and is not licensed to sell securities. None of the information provided is intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, of any company, security, fund, or other offerings. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information contained herein is at your own risk. The content is provided ‘as is’ and without warranties, either expressed or implied. Michiel Laubscher & Laubscher Wealth Management LLC does not promise or guarantee any income or specific result from using the information contained herein and is not liable for any loss or damage caused by your reliance on the information contained herein. Always seek the advice of professionals, as appropriate, regarding the evaluation of any specific information, opinion, or other content.