Mutual Funds, Brokers, Financial Planners, & Financial Advisors love to advertise “Average Returns”.

Wall Street markets to the public using average returns in the financial markets.

There is one massive omission Wall Street makes when they share the gospel of “average returns.”

Average returns are not actual returns.

Here is an example of an average return shared by Wall Street.

Garret Gunderson dedicated a part of his best-selling book “Killing Sacred Cows” to discuss this. Wall St. is filled with Smoke & Mirrors and the “average return” myth is one of them.

You read that correctly, the average return is 25% and the actual return is 0%.

Garret uses exaggerations here just to illustrate a point.

What he’s showing is that a fund can legally advertise “Hey place our money here our average return is 25%, which technically is correct, but the actual investor yield is 0%.

In fact, if you factor in that small 1% management fee & a 30% tax bracket the investor is actually at a net loss of -8.65%but hey we average a 25% return!

So, why do actual yields differ from average returns?

Average yields do not take into account the gains required to make up for a loss.

It takes a higher gain to make up for a loss.

Advisors and fund managers tend to “forget” this part which makes a massive difference.

All those great years you have at 10-12-15-18% “gain” could just be making up for a previous loss and there is no actual gain.

Let’s show a realistic scenario.

Let’s say in 1990 you get a windfall of $100,000, maybe from a parent’s death benefit or the sale of a house.

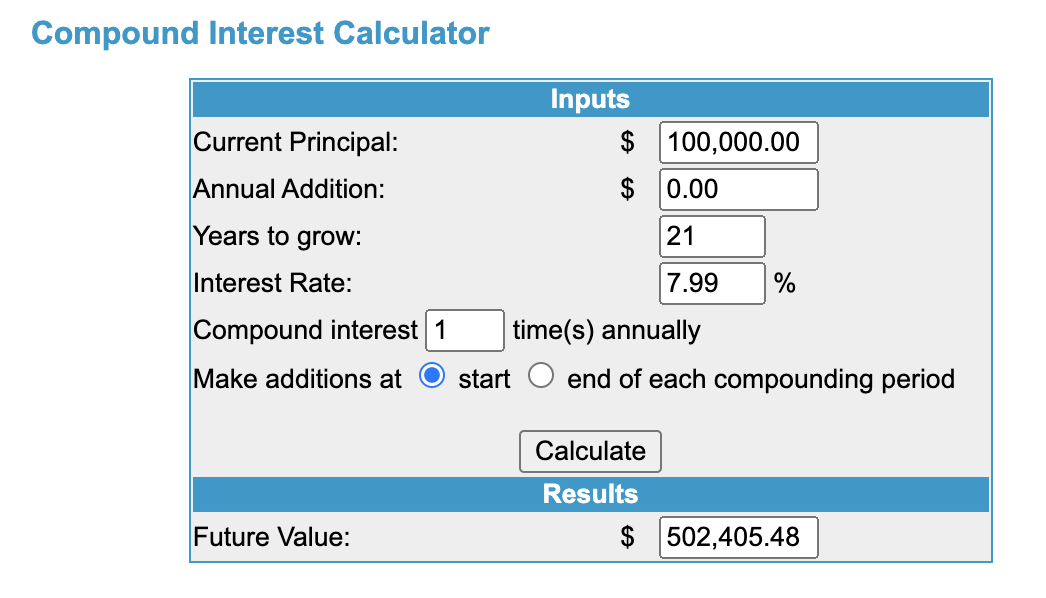

Your advisor tells you to put it into a mutual fund that tracks the S&P Index and pulls up a compound interest calculator and runs a calculation using 8% as an average return.

They tell you some years you will get more than 8%, some years less than 8%, and some years negative but you can expect to average over the long haul by dollar cost averaging an 8% average rate of return.

We have all heard it before, right?

Using 7.99%, you would expect by the end of 2010, in 21 years you can turn $100,000 into $502,405.48 because that’s a 7.9% average return.

However, this does not account for a loss.

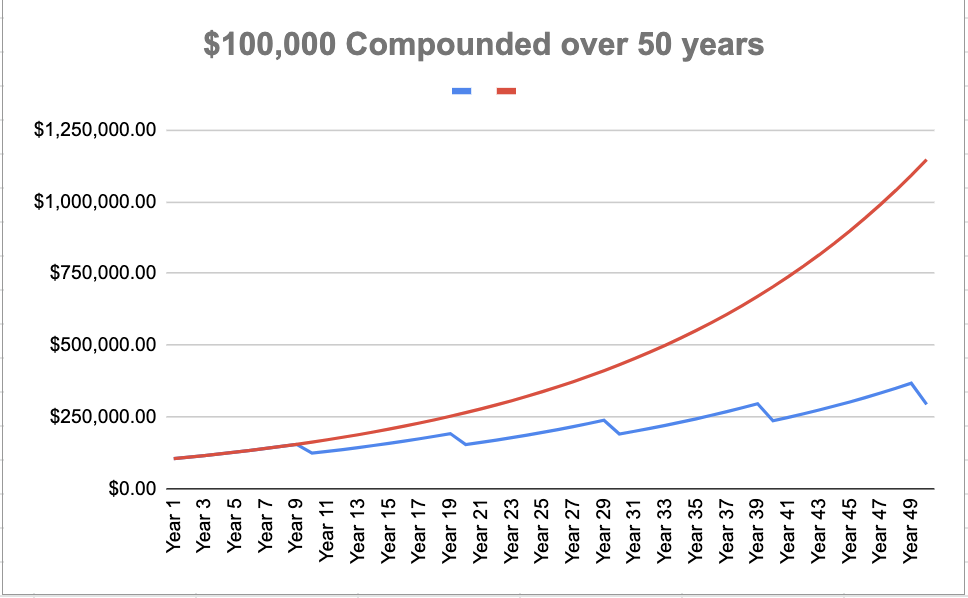

Let’s look at the actual S&P Returns from 1990 until 2010. (I do not use post-2010 for a reason)

Average 7.9% Return right? But way far off from the $502,405.48 you planned on!

That’s about 30% less!

Imagine if you got to retirement with 30% less than you planned for.

If you’re planning for $2 million at retirement and fall short 30%, would you still be able to retire on $600,000 less?

Would your precious 4% rule still allow you to withdraw what you need?

Whenever someone tells you (or brags) about their average return, don’t be fooled by attractive numbers, there’s always more to the story.

So where can you get a guaranteed interest rate with no loss?

High Cash Value Life Insurance!

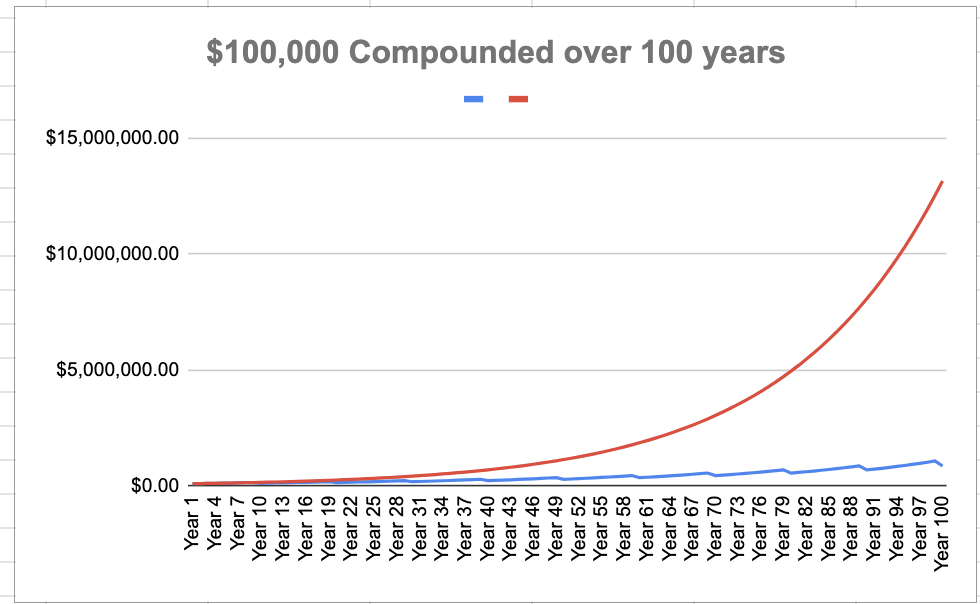

Let’s look at Interrupted Compound Interest (Blue) Vs. Uninterrupted Compound Interest (Red)

Look at the massive difference, especially when scaled out over multiple generations.

In the Producers Capital Account™, you will enjoy uninterrupted compound interest.

Watch all of our educational videos on Infinite Banking here.

Disclaimer and Waiver

Michiel Laubscher & Laubscher Wealth Management LLC is not an investment advisor and is not licensed to sell securities. None of the information provided is intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, of any company, security, fund, or other offerings. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information contained herein is at your own risk. The content is provided ‘as is’ and without warranties, either expressed or implied. Michiel Laubscher & Laubscher Wealth Management LLC does not promise or guarantee any income or specific result from using the information contained herein and is not liable for any loss or damage caused by your reliance on the information contained herein. Always seek the advice of professionals, as appropriate, regarding the evaluation of any specific information, opinion, or other content.