Despite what misinformed influencers may tell you, life insurance is not a hack to “get rich quick.” If you find a way to “get rich quick,” let me know… Unless you happen to be a lottery winner or have inherited millions from a mysterious, long-lost relative, there is no way to get rich quick.

That’s okay… We can do something better. We can Get Wealthy For Sure™.

But before you implement the Aligned Capital Strategy™ to Get Wealthy For Sure™, you need to approach it with the right mindset so your expectations match reality.

In this article, I’m going to show you how to think like a wealthy person so you get the most out of the Aligned Capital Strategy™…

The Power of Knowledge

“The problem in America isn’t so much what people don’t know; the problem is what people think they know that just ain’t so.” –Will Rogers

Knowledge isn’t power. The correct, applied knowledge is power.

If you don’t understand the problem, the solution doesn’t matter. Without an understanding of the problem you face, you’ll be an easy target for people trying to sell you “solutions” that won’t get you the results you want.

And even if you understand the problem and the solution, you have to take your knowledge a step further and apply what you know to take the correct action.

We all are born into this world with no say over what parents, community, and environment we are born into. Usually, we adopt the worldview and mindset of the environment we’re born into. As we grow up, other people come into our lives who bring us new perspectives and new knowledge, but we all begin our lives with the knowledge base of the environment we were born into. Wherever you are today, take a step back and remember the foundation that you started with.

There are 4 types of knowledge:

- Things we know to be true

- Things we think we know to be true

- Things we don’t know

- Things we don’t know that we don’t know

The number one thing I’ve learned from wealthy and successful people is that they’re always interested in #4. They ask themselves, “What’s my blind spot? What can I learn?”

There are three ways to increase your knowledge:

- Through the places you go

- Through the things you read, study, and learn

- Through the people you meet

If you want to Get Wealthy For Sure™, determine what your own blind spots are and discover ways to increase your knowledge.

Focus on Strategies, Not Products

When you play golf, if you’ve spent time practicing your swing, you are positioned to play the best round of golf given your skillset. But if you buy a shiny new golf club and head to the course without taking time to build your skills, you might embarrass yourself… Or even if you do have the skills, but you choose a golf club out of your bag that’s completely wrong for your position, your swing won’t accomplish what you want it to. You wouldn’t tee off with your putter…

On the golf course, it’s all about your swing, club selection, course management, limiting your errors, and recovering from errors without massive damage when they occur.

It’s not about having the golf club… It’s about having the best strategy.

The best players in golf have the best strategy. Just like the best players in the game of wealth have the best strategy.

A strategy must work in any environment. It must be dynamic and flexible so you can adjust to changing circumstances and changes in assumptions. You must be able to track and manage it. It must be verifiable. There must be an immediate feedback loop. It must be simple and easy to implement. Finally, it must be holistic, aligning all the assets within your personal, business, and investment economy.

It can be very easy to drift off into a sea of misinformation and drown in the sole pursuit of a magic product.”–Donald L. Blanton

Your strategy matters, not your product. A fancy product with no strategy, or one that isn’t right for the problem you’re trying to solve, won’t move you toward your goal…

Yet every single financial advertisement you see is trying to sell you a product. You don’t see ads that say, “Let’s match you with an advisor so we can map out the best strategy for you.” You see ads that say, “Everyone needs to buy this stock.”

You can’t win with any one product. To accomplish your goals, you need a strategy to align all of your capital.

Sun Tzu’s The Art of War describes the age-old strategy of divide and conquer. If you divide your enemy, it’s easier to defeat them because they aren’t working against you as an aligned, united front.

The British Empire perfected this strategy and used it to conquer the world. They divided populations into sub-groups and turned them against each other so they could conquer a geographic area without being stopped.

You know what’s crazy to me? We understand this strategy when it comes to warfare, yet when it comes to finances, many people believe in diversifying assets.

Why would you knowingly divide your capital and resources to weaken your financial strategy?

There is a time on your journey when you do need to diversify, and there is a strategy to doing it successfully (it’s not what you’ve been told and sold!). But there is a difference between diversifying intentionally using a thought-out strategy and doing what most people do, which is, “Oh, I’ve heard I should diversify my assets, so let’s move some money over here into this stock… Hope that works out!”

Most people deworseify, not diversify.

Aligning your capital places you in the strongest position to Get Wealthy For Sure™.

It’s the difference between executing a strategy with a united army working together in unison or executing the same strategy with a disorganized, divided army.

If you know a strategy works, why not align all of your capital into one “army” so you can execute this strategy with maximum effect?

Why Not Just Invest in the Stock Market?

“I suppose if I were to give advice it would be to keep out of Wall Street.”

–John D. Rockefeller

Some people might read about the Aligned Capital Strategy™ and think, “I get the point, but I can get better returns in the stock market.”

Sure, but the Aligned Capital Strategy™ is a savings vehicle, not an investment vehicle.

There’s a massive difference between saving, investing, speculating, and gambling.

When you save, you’re putting your capital into a vehicle with guarantees that it is never going to go down in value. Because of these guarantees, you get a very conservative return.

Investing is when you place capital in a vehicle, taking on a massive risk with the hopes of getting a bigger return–but you can lose some or all of the capital that you put in the vehicle.

You should only invest in what you know, and you should know that the more levels you move away from the investment, the less control you have over the outcome.

Saving is the bird in hand, and investing is the bird in the bush.

Then, we have speculation, which is a completely different approach. Speculation is when you can see imbalances and distortions in the marketplace and make predictions about what could happen. You’re capitalizing on asymmetric opportunities in the marketplace, but you could lose some or all of your money.

Gambling is when, beyond the rules of the game, you have zero control over what the outcome will be. All you have is luck. You could lose some or all of your money to gambling. Even when you can count cards and win a lot, the house will always win since the game of gambling is designed that way.

A dividend-paying whole life insurance policy with a mutual insurance company is a guaranteed savings vehicle. You will not lose money, and your money is contractually guaranteed to grow. Your capital will be growing more conservatively tax-free since it’s a savings vehicle, but you will have consistent growth and never lose a penny.

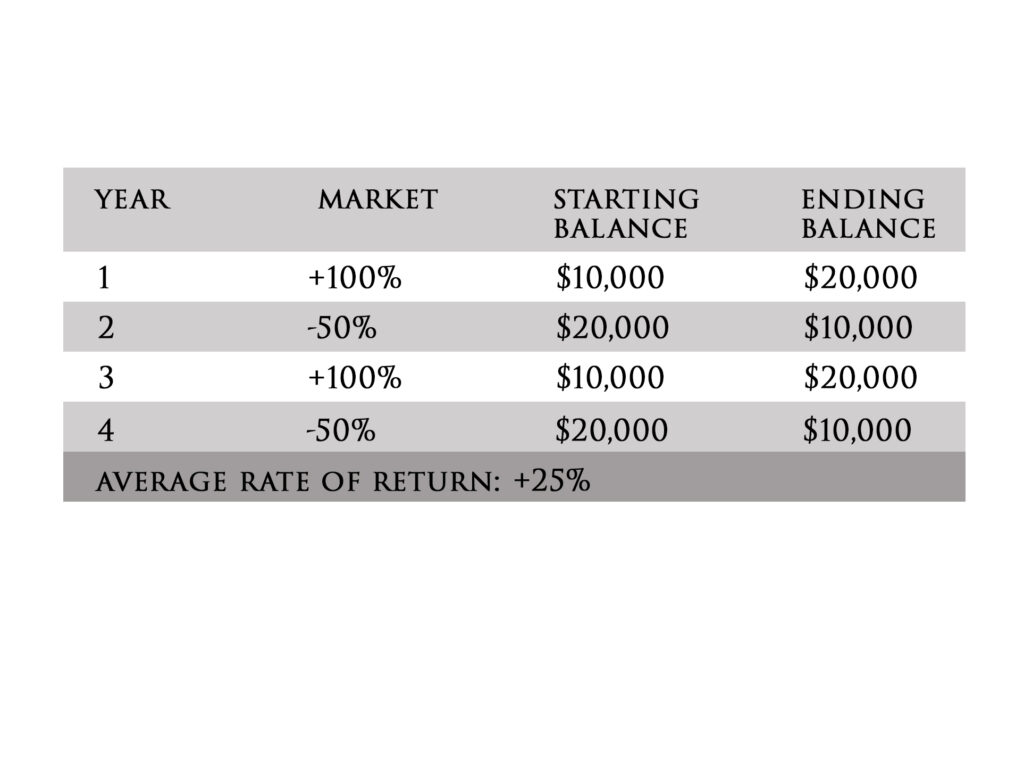

There is a massive difference between actual and average returns in the stock market. If you have $10,000 in stock and that stock goes up 100% in year 1, then falls 50% in year 2, in year 3, the stock goes back up 100%, and in year 4, it falls 50% again. Your average return in this example is 25%, yet your account balance is the exact same amount you started with in year 1 at the end of year 4: $10,000. You had a 25% return with $0 profit. We did not include any fees that were taken out in this example. If you include management fees, this account will be negative with a 25% return.

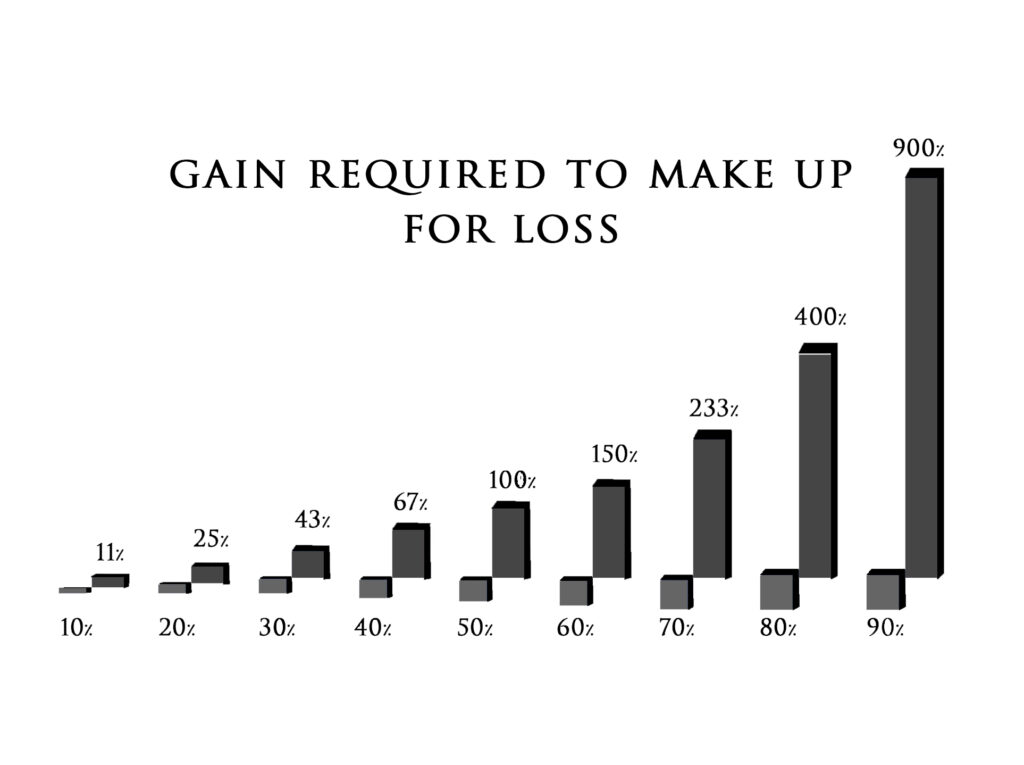

What financial planners also do not tell their clients is how much your portfolio needs to generate in returns to make up for losses in the market.

If your portfolio loses 70% of its value, you need to have 233% in gains to make up for the 70% in losses.

Do you now see why it is more important to make sure you do not lose capital rather than chasing shiny objects and trying to find the next Apple stock or Bitcoin?

There’s also a difference between pre-tax returns and post-tax returns. Let’s pretend you’re getting an 8% average return in the market. (The key word is pretend… Our kids play pretend, so why can’t we?) Even if we’re living in a fantasy pretend world where you get an 8% return, that’s pre-tax. How much of your return will you get to keep after tax? The answer will be different depending on your financial situation, but the point is, your return will be less after tax. For example, if you have a 20% capital gains tax, your return might get bumped from 8% to 6.4%. So not only is your actual return less than the average return you were advertised but part of that actual return will get eaten by taxes.

“Just because you’re following a well-marked trail doesn’t mean that whoever made it knew where they were goin’.” –Texas Bix Bender

Opportunity Cost

Don’t fail to consider the opportunity cost of what you do with your money…

Business owners may think, “Well, I’m investing in my business and making money.” That’s great, but what they don’t realize is that they’ve lost the opportunity to invest in the business while also having uninterrupted compounding in the policy.

Let’s say your money is in a savings account earning 5%. Suddenly, you need to take that money out of the savings account to cover an emergency. Once you take the money out, it stops compounding. You lose the opportunity cost of the 5% the money could have earned if you had left it in the savings account.

You finance everything you purchase. You either pay interest by purchasing it with a loan or credit card, or you lose interest you could have earned by paying it with cash. Either way, there’s a cost to any investment.

Let’s take a look at three strategies of how we finance things to see how important opportunity costs are.

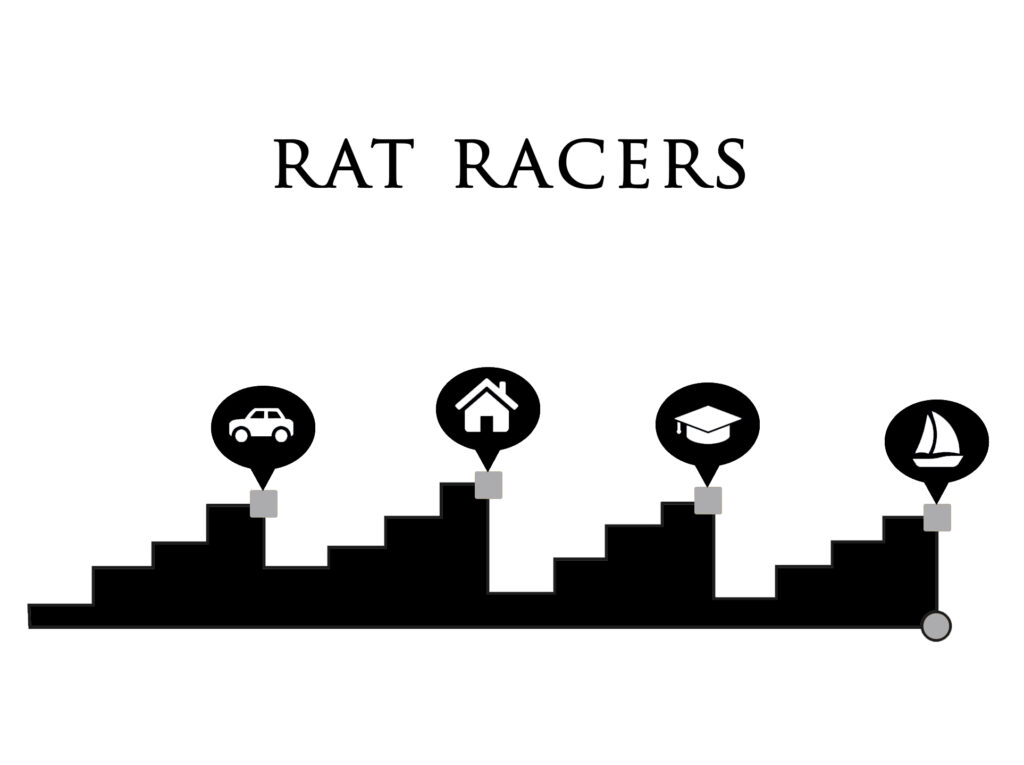

There are three financing characters out there in the economy, Rat Racers, Borrowers, and Producers.

Rat Racers save cash and then purchase things with cash savings, losing the ability to earn compound interest on their savings as they are always drawing down their savings to zero and then restarting the savings process.

Borrowers do not save, they borrow money from banks and financial institutions and pay interest and principal to these banks and financial institutions. Borrowers are on the opposite end of a compound interest equation, always just trying to dig themselves out of a hole paying back the debt owed and getting back to zero.

Producers save and warehouse capital efficiently in assets that can be placed as collateral for loans at favorable rates and favorable and flexible repayment terms. This way they can generate uninterrupted compounded growth on their savings and finance the growth of their business or investment portfolio simultaneously.

With the Aligned Capital Strategy™, your money is working in two places simultaneously. It’s in the policy compounding tax-free, but if you need to take money out of the policy, you take it as a loan, so there is no interruption to the compounding. You don’t lose the opportunity cost of deciding whether to keep money invested in a vehicle or take it out to use it for an emergency or opportunity. You can have both.

Risk Management

We should all be our own wealth managers, and the biggest part of wealth management is risk management.

The stock that you buy for $1 that grows to $100 is a sexy story to tell at a cocktail party. But you will actually see bigger increases and more significant gains overall in your wealth by minimizing losses than by chasing massive gains.

Just ask my son, who’s a huge baseball fan. It doesn’t do you much good if you get a few major home runs early in the game if you can’t stop your opponents from scoring. Sports teams have to play both offense and defense to win. Likewise, if you want to get wealthy, you need to focus on both increasing your wealth and minimizing losses.

There is a better return in managing risk and optimizing efficiency than in trying to pick the next big investment that will be a home run!

In sports, offense wins you games, but defense wins you championships.

The Value of Control

What is the value of control over your life to you? This answer will be different for everyone. You can control a lot of things in your life. You can control your mindset, and to a certain extent, your physical, mental, and spiritual health. You can control what happens in your home, with your marriage, with your children. You can control what happens in your business–who’s on your team, what strategy you’re implementing and executing, what the systems are, what the processes are. Yes, there are always external factors in every area of life at play, but you can control how you react to them. You can’t control everything, but you can control how you think and act.

What is the value of control when it comes to your financial life? You can’t control the market. You can’t control the economy. You can’t control the tax code. You can’t control your country’s leadership and the policies of the government.

There are so many unknown variables…

But there are things you can control when it comes to your wealth.

If there was a strategy that could place you in full control of your wealth, as the leader who is stewarding and managing your own assets, how much value would you place on that?

Stop Hoping and Start Preparing

Most strategies are just “hoping.”

You hope someone will buy the business when you want to sell it… You hope the stock market doesn’t crash… You hope you have liquidity on hand when an opportunity arises… You hope that markets are at an all-time high when you sell your stocks to access the money that you invested… (When you do this, you’re “timing the markets,” which is exactly what investors tell you not to do)…

Stop hoping and start preparing!

I believe in preparation over predictions. As human beings, we want to know what’s going to happen tomorrow–but the reality is that we can never know what tomorrow will bring. We can “forecast” and “predict” all we want, but that’s about as useful as shaking a Magic 8 ball or having our palm read by a psychic… Instead of trying to predict the future, prepare for it. Nobody could have predicted 2020… But the business owners who survived were the ones who had prepared for any crisis by having emergency liquidity on hand.

The Chinese word for crisis is “Wei Ji.” Wei means crisis, and Ji means opportunity. They are one and the same. Every business owner should adopt this mindset. If we prepare for any potential crisis, when it occurs, we’ll be able to not only survive, but capture opportunities that our competitors, who looked into a fogged-up crystal ball that told them the future would be easy, are unable to.

We can think of financial planning as climbing a mountain. You start at the bottom of the mountain, looking up at the peak that you want to reach. Then, you put in thirty or forty years of hard work backpacking up the mountain, accumulating assets, until, finally, you reach the top–the peak of your wealth. Now, you have to climb down the mountain on the other side, using the assets you’ve accumulated as income in retirement. (If retirement is even your end goal… I don’t believe in the word “retirement.” Why would I want to be put out of use and stop contributing value to society? But that’s a story for another book…)

Traditional financial planning tells you to put your money in the financial markets while you’re climbing the mountain. But the financial markets can only go up, down, and sideways. You have no control over them. Furthermore, you’ve deferred your taxes to the future, when you have no idea how high tax rates will be. You also don’t have a plan to cover fees and commissions… This means that as you’re climbing the mountain, you have no idea how much capital will be set aside for retirement when you get to the top because you don’t know what the markets or tax rates will be like at that time or how much you’ll lose to fees and commissions. You’re hoping that the markets are at an all-time high when you get to the summit… You’re trying to “time” the markets, which is what every financial professional tells you not to do. If the market is at an all-time high, as you hope, you’ll be able to turn your mountain of money into income to fund the back end of the mountain.

But what happens if you reach the top of the mountain and find that the market is not at an all-time high?

The danger of hoping is that there is no certainty. You can hope for something to happen as hard as you want, but that doesn’t mean it will ever happen. When you hope, you have no control.

If you’re planning to turn your assets into income when you get to the top of the mountain, why wouldn’t you focus on a strategy while climbing up the mountain that gives you guarantees, predictability, security, fee transparency, and a tax strategy? Why wouldn’t you eliminate the uncontrollable variables rather than hoping they work out for the best? Wouldn’t you rather know with certainty how much capital you will have when you reach the summit? Wouldn’t you rather climb up the mountain knowing you’ll be able to climb down?

Understanding the Commitment

Before you implement the Aligned Capital Strategy™, you need to understand that it is a long-term commitment.

Once you set this vehicle up, you’re going to pay into it for years. If you have a place where you can position capital that is growing tax-free, and you can access this capital at any given point in time, and this vehicle guarantees that your net worth will increase with every single contribution that you make, would you want to stop putting money in there, or would you want to put as much money in there as you can?

Even if you get a large sum of money or want to move money from your retirement account, this strategy is about the long-term results, not the quick wins.

Wealthy families think three or four generations ahead. They’re focused on preserving wealth for their great-grandchildren. When family offices make investments, they focus on making investments for 100 years. They don’t invest in the flashy tech startups that are hot today but gone in five years. They make investments that they believe will be around for the next 100 years because their goal is to preserve wealth across generations of the family.

Meanwhile, the average person is upset if their investments don’t make them rich in twelve months, or they freak out if the market is down today. Don’t focus on today or even this year… Focus on the big picture.

This strategy is about consistent discipline… If we were a baseball team, we would be the team that gets base hits and has a strong defense, not the team that gets a few flashy home runs but loses the game.

Let go of any illusions that you’ll be able to use this strategy to get rich overnight and win one game. Instead, focus on a long-term strategy of winning over the course of the season, winning the championship, and continuing to have winning seasons and win championships.

Watch all of our educational videos on Infinite Banking here.

Disclaimer and Waiver

Michiel Laubscher & Laubscher Wealth Management LLC is not an investment advisor and is not licensed to sell securities. None of the information provided is intended as investment, tax, accounting, or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, of any company, security, fund, or other offerings. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information contained herein is at your own risk. The content is provided ‘as is’ and without warranties, either expressed or implied. Michiel Laubscher & Laubscher Wealth Management LLC does not promise or guarantee any income or specific result from using the information contained herein and is not liable for any loss or damage caused by your reliance on the information contained herein. Always seek the advice of professionals, as appropriate, regarding the evaluation of any specific information, opinion, or other content.